10 tips for increasing your data-driven decision-making mojo

Companies skilled at data-driven decision-making can create real competitive advantage over less capable rivals. Yet being able to do this well is also a growing challenge for many companies – not because they lack data, but because they lack the skill to use the data effectively.

Below are 10 best practices to drive better data-driven decision-making.

Zoom up

One of the most common mistakes in data-driven decision making is rushing into the analysis phase before properly considering the context.

Before you jump in and start crunching numbers, take a step back and place the decision in a wider strategic frame. What problem are you trying to solve, or what opportunity are you hoping to address, with this decision? What potential solutions or outcomes are you considering? Is this a “go / no go?” decision? If so, you may be too narrowly focused on one option.

Consider what information or data sets are most valuable to help you make the best decision. You may find that the data you were about to work with isn’t the most optimal, it was simply the most available.

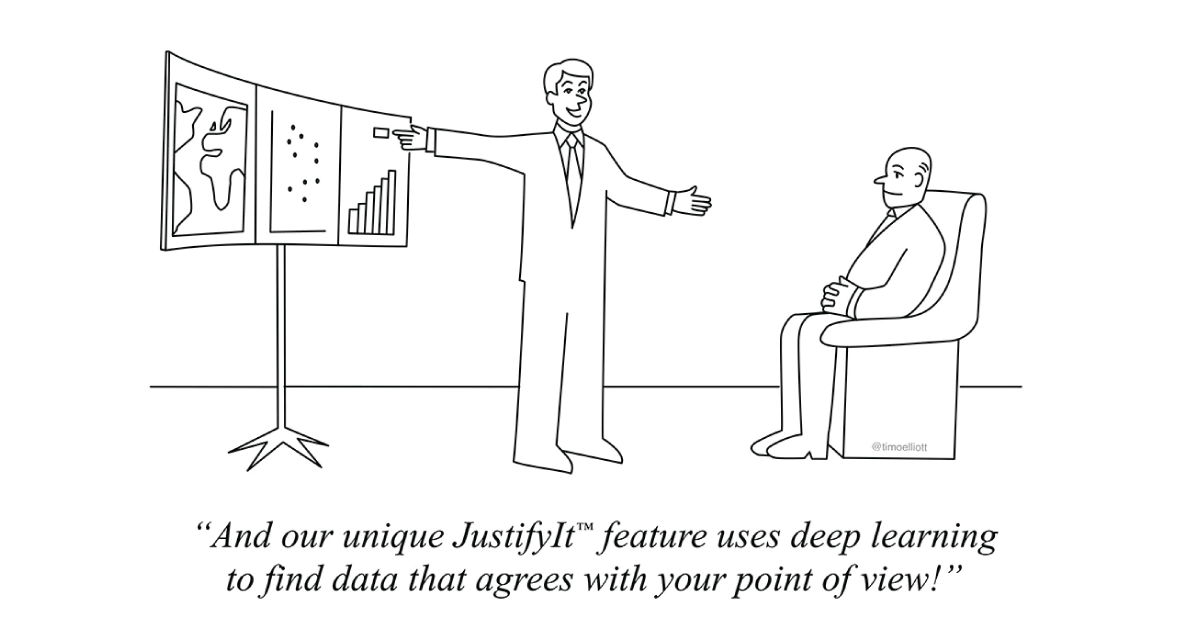

Beware confirmation bias

As the cartoon above so beautifully illustrates, we have a propensity to find data that confirms our existing beliefs and ignore data that contradicts them. Be careful that you’re not just running the analysis that provides the answer you (or your boss!) wants to hear.

Don’t get too attached to the answer you think you’ll get or the one you desperately want to generate from the data. Be open to where the data leads you, and take special care when you find evidence that disconfirms your beliefs. When you observe contradictory data, apply what Charles Darwin called “the golden rule”:

“I had, also, during many years, followed a golden rule, namely, that whenever a published fact, a new observation or thought came across me, which was opposed to my general results, to make a memorandum of it without fail and at once; for I had found by experience that such facts and thoughts were far more apt to escape from memory than favorable ones. Owing to this habit, very few objections were raised against my views which I had not at least noticed and attempted to answer.” – Charles Darwin (1)

Know when not to trust your gut

Intuition comes from your brain and body’s pattern recognition based on direct or vicarious experience. When you have many cycles of relevant experience with the exact type of decision you now have in front of you (and you’ve also gotten clear, unambiguous learning from the prior decisions), your intuition can be a powerful ally in your decision-making.However, many decisions today involve areas where there is uncertainty, and where we lack relevant experience. In such situations, beware – one’s gut feel could be tied to various predictable decision traps, and thus not trustworthy.When making an important decision in an area where you don’t have deep expertise and many cycles of experience making very similar decisions, a good rule of thumb is to start with objective data and use rational analysis.Build your pattern recognition muscle

Train yourself to constantly be looking for patterns everywhere. Data analysis is, at its heart, an attempt to find a patterns within (or correlation between) different data points. It’s from these patterns and correlations that insights and conclusions can be drawn that can then inform your decisions.Whether you’re reading the Wall Street Journal, listening to the chatter while standing in line at your local Starbucks, watching the flow of rush hour traffic beneath you as you fly into Chicago, or just surfing the internet, look for patterns in the data around you.Once you have noticed patterns, practice extrapolating insights from those patterns and try to draw conclusions as to why they exist. Also practice posing questions to yourself about what possible counter-intuitive correlations or trends might be hidden in the data in front of you.This pattern recognition practice can help you train yourself to become more curious and data-driven in all areas of your life!

Create experiments

When facing a big, consequential decision, seek opportunities to create experiments before you go “all in.” In software development it is common to release a minimum viable product (MVP) – a scaled-down version of an application with just enough features to make it useful and test it out.

By releasing an MVP, you gain valuable data from real customers on how they’re using the product. The data from this MVP then informs which features to add and what needs to change in the next version.

The MVP mentality isn’t just for software development. After all, don’t we usually date before we marry, or try before we buy? You can apply it to just about any decision.

The key is to test the waters via a preliminary decision or a smaller version of a bigger decision as soon as possible, and then pay attention to the data so that you can revise or improve the bigger decision.

Also, try breaking down a big decision into a series of smaller decisions with which you can test the waters. For example, if you are trying to decide where to move, why not first stay at an Airbnb for some long weekends in several of the locations you are considering and be open to what you learn in the process?

Cultivate a mindset of each of these decisions being mini experiments with the future!

Differentiate between signal and noise

One reality in business today is the overwhelming volume of information that is often available, and swirling around, decisions. Skilled decision-makers are very good at clearly identifying the critical “must-have” info and data.Ask yourself: What is the data that, if you didn’t have, would make it almost impossible to proceed with the decision? Focus your analysis on that data set, which we call the “signal.”Often a decision can be boiled down to a small number of variables that will have a material impact on the outcome. “Noise,” on the other hand, seems relevant, is typically easy to gather, and yet it doesn’t add much value to the decision process (and may even negatively impact it or distract you from focusing on the most important data).Before spending considerable time and effort gathering data, or running analysis on a data set, consider whether it is signal or noise.

Apply the 70% rule

When making decisions under uncertainty, we have a natural tendency to want 100% of the information we need to make the best possible decision. The problem is, it takes time and effort to gather all the relevant information, and often the delay in making the decision is more costly than any advantage you get from having access to 100% of the data.

Jeff Bezos understands the power of speed in decision making, and he encourages employees at Amazon to use the “70% rule:”

“Most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being slow. Plus, either way, you need to be good at quickly recognizing and correcting bad decisions. If you’re good at course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure.” – Jeff Bezos (2)

Visualize the data

Whenever possible, use visualization to help make connections, find patterns and uncover critical insights in the data. It is much more difficult to find correlations and insights when looking at tables of numbers. Yet, convert that same table into a time series, scatter plot or graph and you might be surprised by what you find.The key to analysis is turning data into actionable insights that will help you make better decisions.Consider the base rate

When making decisions we are often estimating the probability of various potential future outcomes. For example, when making an investment decision, you might predict that a certain company will grow its earning by 30% per year for 5 years.

Before making the decision, you should consider what percentage of companies in the past have ever achieved that kind of growth rate (aka the ‘base rate”).

What you will find is that only 3.4% of companies have ever achieved that kind of sustained growth.(3) With this knowledge in hand, you may want to revisit your original prediction.

By paying attention to base rates, you can avoid overconfidence and more accurately estimate probabilities and outcomes.

Communicate the story in the data

When you need to gain support for a data-driven decision, there is usually a story in the data that informed your decision in some way. Your ability to share the data story helps you bring along others who may need to either support or execute the decision.

Stories provide an emotional hook that enable people to understand and remember complex data-based relationships. Practice finding and telling the story in the data.

With the growth of software and the cloud, organizations are generating and getting access to more data than ever. Leaders who learn how to use this data to make more effective decisions will enjoy a competitive advantage.

According to a survey of more than 1,000 senior executives conducted by PwC (4), highly data-driven organizations are 3 times more likely to report significant improvements in decision-making compared to those who rely less on data.

Although the term “data driven” implies that data is driving the decision from one step to the next, human judgment and expertise are still very much involved.

How we frame the decision, what data to analyze, how we separate the signal from the noise – these are the judgment calls that separate great decision makers from just merely good decision makers. This is where the “mojo” happens.

Use these 10 tips to increase your decision mojo and start making smarter data-driven decisions.

References:

1) Darwin’s Autobiography

2) Jeff Bezos 2016 Letter to Shareholders

3) Base Rate Book, Credit Suisse, Sept 26, 2016, Michael Mauboussin, Dan Callahan, Darius Majd

4) https://www.pwc.com/us/en/services/consulting/analytics.html

- 3 decision-making lessons from ‘A Christmas Carol’ - December 19, 2023

- 8 ways to use generative AI to improve decision-making - December 4, 2023

- The NBA’s 3-point shot provides a cautionary tale for leaders navigating disruptive innovation - May 30, 2023